CMHC: First Time Homebuyers Incentive

In September of this year, the Canadian Mortgage and Housing Corporation had launched a new incentive program.

This program is geared towards first-time home buyers to help qualified new homebuyers reduce their monthly mortgage carrying costs without adding to their financial burdens. This program will benefit first time homebuyers who choose to purchase through North Prairie Developments! New construction homes and town homes could get up to 10% of their new home covered.

For many Canadians, especially young people and first-time buyers, finding an affordable place to call home is not just a challenge – it feels like an impossibility. There aren’t enough houses for people to buy or apartments for people to rent. That makes finding a good place to live too expensive and beyond what many people, especially younger Canadians, can afford.

This initiative is designed to help young Canadians access home ownership in a fiscally responsible and affordable way. Statistically, this is the demographic group with the lowest percentage of homeownership.

What properties are eligible?

- The Incentive is to help first-time homebuyers purchase their first home. Eligible residential properties include:

- New construction

- Re-sale home

- New and re-sale mobile/manufactured homes

Types of residential properties include:

- Single family homes

- Semi-detached homes

- Duplex

- Triplex

- Town houses

- Condominium units

IMPORTANT: The property must be located in Canada and must be suitable and available for full-time, year-round occupancy.

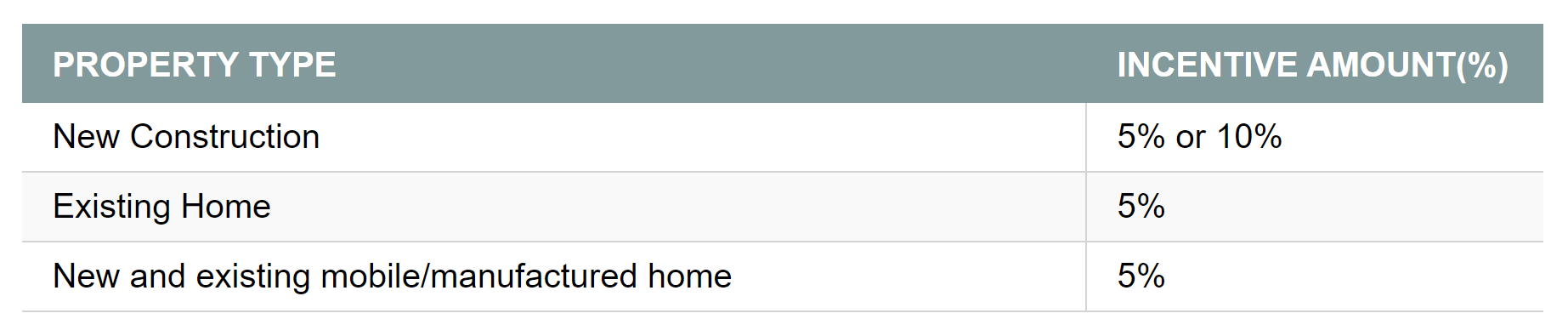

Incentive by Property Type

How will this help younger Canadians struggling to save for a down payment?

In all cases, the borrower must meet minimum down payment requirements with traditional sources such as savings, withdrawal/collapse of a Registered Retirement Savings Plan (RRSP), or a non-repayable financial gift from a relative/immediate family member. By obtaining the Incentive, the borrower may not have to save as much of a down payment to be able to afford the payments associated with the mortgage.

How does it work?

The Incentive enables first-time homebuyers to reduce their monthly mortgage payment without increasing their down payment. The Incentive is not interest bearing and does not require ongoing repayments.

Through the First-Time Home Buyer Incentive, the Government of Canada will offer:

5% for a first-time buyer’s purchase of a re-sale home

5% or 10% for a first-time buyer’s purchase of a new construction

How much do you have to pay back?

You can repay the Incentive at any time in full without a pre-payment penalty. You have to repay the Incentive after 25 years or if the property is sold, whichever happens first. The repayment of the Incentive is based on the property’s fair market value.

You receive a 5% incentive of the home’s purchase price of $200,000, or $10,000.

If your home value increases to $300,000 your payback would be 5% of the current value or $15,000.

You receive a 10% incentive of the home’s purchase price of $200,000, or $20,000 and your home value decreases to $150,000, your repayment value will be 10% of the current value or $15,000.

NOTE: If your property value goes down, you are still responsible for repaying the shared equity mortgage based on the current home value at time of repayment.

To apply for this incentive, you have to qualify with the following:

- Have the minimum down payment to be eligible

- Maximum qualifying income is no more than $120,000

- Total borrowing is limited to 4 times the qualifying income

If you meet these criteria, you can then apply for a 5% or 10% shared equity mortgage with the Government of Canada. A shared equity mortgage is where the government shares in the upside and downside of the property value.